mississippi income tax rate 2021

Mississippi has a graduated tax rate. The Federal or IRS Taxes Are Listed.

Shadow Health Cardiovascular Trascript Latest 2021 In 2022 Student Survey Exam Nursing Notes

The Mississippi Income Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. Married taxpayers must make more than 16600 plus 1500 for each qualifying dependent. DATEucator - Your 2022 Tax Refund Date.

3 on the next 1000 of taxable income. Discover Helpful Information And Resources On Taxes From AARP. These rates are the same for individuals and businesses.

By Bobby Harrison March 22 2021. Your average tax rate is. For tax year 2021 the first 4000 of earned income would not be taxed and the next 1000 is taxable at a rate of 3.

5 on all tax See more. Mississippis SUI rates range from 0 to 54. Ad Compare Your 2022 Tax Bracket vs.

Eligible Charitable Organizations Information. Income ranging between 5000 to 10000 would be taxed at 5. Find your pretax deductions including 401K flexible account contributions.

See Why Were Americas 1 Tax Preparer. The taxable wage base in 2022 is 14000 for each employee. There is no tax schedule for Mississippi income taxes.

Corporate Tax Rates and Brackets. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Mississippi. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000.

There is no tax schedule for Mississippi income taxes. 2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Senate kills Mississippi income tax elimination.

Tax rate of 4 on taxable income between 5001 and 10000. Income Tax Rates and Brackets. Because the income threshold for the top bracket is quite low.

Also beginning in 2018 a new exemption of the first 100000 of capital value will be exempt from tax. 4 on the next 5000 of taxable income. A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate.

By Geoff Pender March 16 2021. How to Calculate 2021 Mississippi State Income Tax by Using State Income Tax Table 1. Tax Year 2021 First 4000 0 and the next 1000 3 Tax Year 2022 First 5000 0 Link to MS state site.

Any sales tax that is collected belongs to the state and does not belong to the business that was transacted with. Mailing Address Information. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200.

Ad File Your State And Federal Taxes With TurboTax. Bills being signed off on before being presented at the Mississippi Capitol during the 2021 legislative session. Since taxpayers have the choice of using either their 2020 or 2021 income to establish eligibility.

Medical marijuana and taxes the hallmark 2021 legislative efforts are likely dead. Your average tax rate is. Tax Rate Income Range Taxes Due 0 0 - 4000 0 within Bracket 3 4001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket.

For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the MS tax rates and the number of tax brackets remain the same. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA. Your 2021 Tax Bracket To See Whats Been Adjusted.

Beginning in 2018 the franchise tax rate of 250 per 1000 of capital value will begin to drop. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. The graduated income tax rate is.

Tax rate of 5 on taxable income over 10000. Mississippi Tax Brackets for Tax Year 2021 As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Earned Income - EITC.

Mississippi Income Tax Calculator 2021 If you make 75000 a year living in the region of Mississippi USA you will be taxed 12822. Find your income exemptions 2. A big law partner who was a married second-year associate in 2020 could have much more than 250000 in household income now and still come in below.

For 2022 the first 5000 of income tax is not taxed. Find your gross income 4. The Mississippi State Tax Tables below are a snapshot of the tax rates and thresholds in Mississippi they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Mississippi Department of Revenue website.

Check the 2021 Mississippi state tax rate and the rules to calculate state income tax 5. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Find and Complete Any Required Tax Forms here.

On the income tax the bill slowly reduces the tax rate on lower levels of income until the first 5000 is exempt from tax. Tax rate of 0 on the first 5000 of taxable income. 2 days agoRecent State Tax Changes.

The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. 11 - Mississippi Business Tax. Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

See If You Qualify To File State And Federal For Free With TurboTax Free Edition. Ad Get Ready for Tax Season Deadlines. Note that for tax year 2021 the first 4000 in taxable income is not taxed.

15 Tax Calculators 15 Tax Calculators. 10 - Mississippi Corporate Income Tax Brackets Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. These rates are the same for individuals and businesses.

Unlike the Federal Income Tax Mississippis state income tax does not provide couples filing jointly with expanded income tax brackets. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. In tax year 2022 the 3 percent rate is scheduled to be repealed leaving the 4 percent rate on marginal income exceeding 5000 and the 5 percent rate on marginal income exceeding 10000.

Notably Mississippi has the highest maximum marginal tax bracket in the United States. 0 on the first 2000 of taxable income 3 on the next 3000 of taxable income 4 on the next 5000 of taxable income 5 on all taxable income over 10000 More Help With Taxes in Mississippi. The graduated income tax rate is.

MS DOR Looking for more tax information and tips. Any income over 10000 would be taxes at the highest rate of 5. Corporate Income Tax Division.

House tries to revive it. 0 on the first 4000 of taxable income. Combined Filers - Filing and Payment Procedures.

Corporate and Partnership Income Tax Help. 7 State Taxes 007 Average local tax 707 Combined Tax Property Taxes. 2021 Tax Year Return Calculator in 2022.

Hurricane Katrina Information.

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Missouri Income Tax Rate And Brackets H R Block

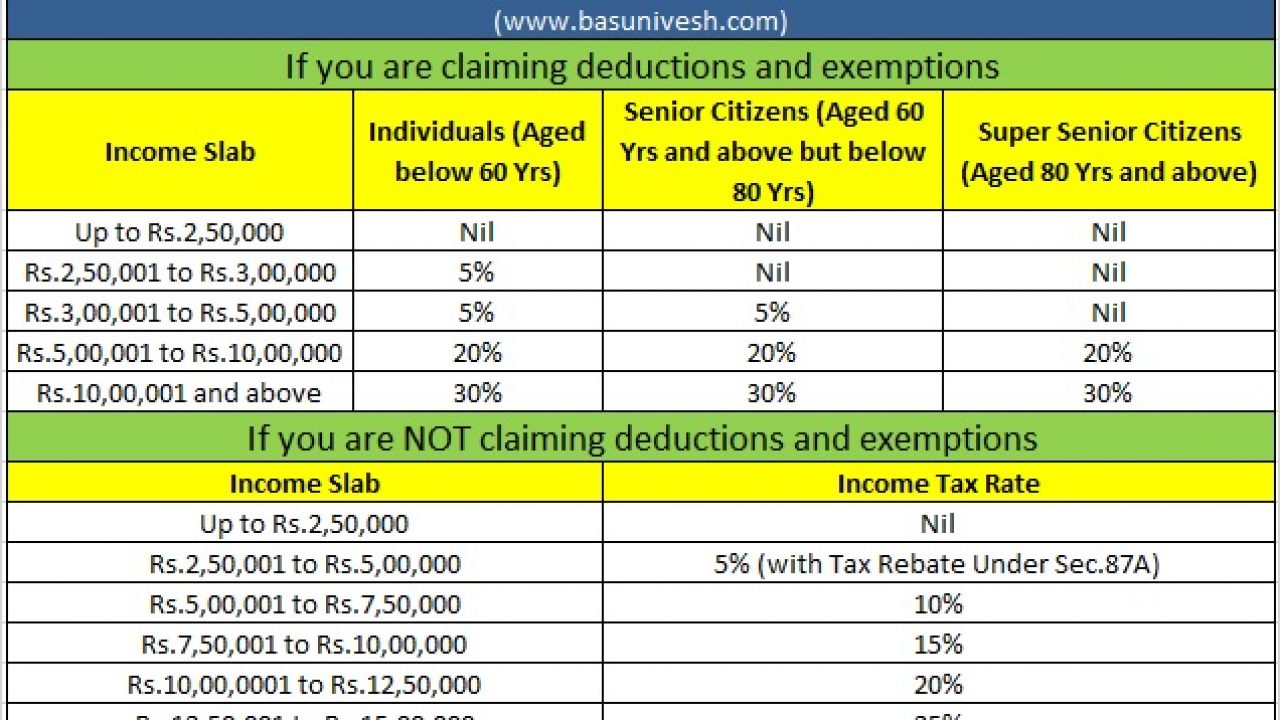

Latest Income Tax Slab Rates Fy 2020 21 Ay 2021 22 Basunivesh

State Corporate Income Tax Rates And Brackets Tax Foundation

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Where S My State Refund Track Your Refund In Every State

Free 9 Sample Income Verification Forms In Ms Word Pdf

Income Tax Deductions List Fy 2019 20 How To Save Tax For Ay 20 21

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Section 87a Tax Rebate Fy 2019 20 Income Tax Return Rebates Wealth Tax

State Income Tax Rates Highest Lowest 2021 Changes

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Cukai Pendapatan How To File Income Tax In Malaysia

Ipl S Richest Star Ms Dhoni Sportbusinessnews Ipl Msdhoni Incometax Jharkhand Newsalert Topnews Dh Ms Dhoni Photos Dhoni Wallpapers Ms Dhoni Wallpapers

Apartments Flats Lands For Sale In Bangalore Stamp Duty Income Tax Plots For Sale

State By State Guide To Taxes On Retirees Kiplinger American History Timeline Retirement Advice Retirement Planning